In the beginning, central banks' first steps into the murky waters of 'QE' were tentative. They clearly wanted to buy as much as necessary but as little as possible, frightened of long-term side-effects that they couldn't yet contemplate. The same was true of negative interest rates. But as time has gone on, we and they (the Fed et al) have started feel that we understand the impact of central bank intervention in bond markets little more. And yes, a little knowledge really can be very dangerous!

When the Fed first bought bonds, there was a flurry of research papers trying to gauge how big the impact would be on bond yields, particularly he yield on longer-dated Treasuries. Disentangling the relative importance of the bond-buying from the accompanying (super-low) interest rates, along with the longer-term economic consequences of the financial crisis (modest growth in GDP, low wage growth and below-target inflation inter alia) was never going to be straight-forward. But it's been easier for the sell-side research community to get its head around what bond-buying meant for the yield spread between government debt and the other bonds that investors were being crowded into. These three charts, posted on twitter over the last few weeks from research reports written by BofA Merrill Lynch and Citi's Matt King, sum up the state of thinking.

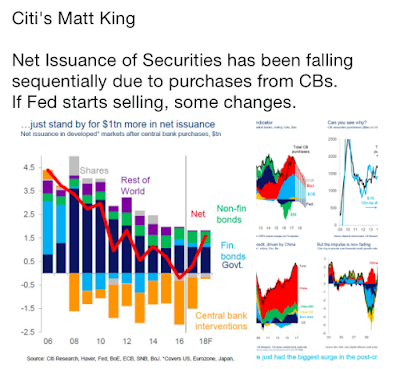

1) The net supply of bonds to the private sector investor universe has dwindled to almost nothing, if central bank buying is subtracted. A disaster if you are trying to get some decent yield into your pension portfolio, a recipe for investors to go hunting in ever more exotic places in their search for yield. Hundred-year Argentina bonds anyone?

2) A similar story from Matt King - if the Fed stats selling, global bond issuance goes from just below zero in 2016, and a few hundred billion dollars in 2017, to $1.5trn in 2018. And in the third picture, which is a blow-up of the top-right chart in the second, you can see the conclusion he reaches: less buying of bonds by the Fed et al is bad for corporate bonds and implies wider spreads.

Note that these aren't just charts of Fed bond-buying. They show global asset purchases, and maybe that too plays a part in Fed thinking: If what markets are sensitive to is the collective actions of central banks, maybe it's better to be first to shed excess assets, rather than waiting for the ECB, BOJ and Bank of England to join in, by which time any impact on credit spreads (and on absolute yields) will already be being felt and Fed action would exacerbate it.

I also think it's interesting to consider that the actions of the Fed affect markets differently than the action of other central banks. The next chart highlights the challenge facing the ECB and comes from their latest Economic Bulletin showing the impact of ECB bond-buying on various investor communities.

The ECB estimates that the Eurosystem owns EUR 1.1trn more government bonds than they would have otherwise, as a result of activities between March 2015 and march 2017. A little more than half of that has come as a result of crowding out European banks and investors, and a little under half has come as a result of crowding out foreign investors. It doesn't take a huge leap of faith to conclude that where the main impact of goal bond-buying globally (and Fed buying in particular) has been on credit spreads, the impact of the ECB being has also been felt in the currency market, as foreign investors were squeezed out of euro-denominated assets (and Europeans were squeezed out of euros, for that matter).

Where does that leave me, as I ponder Tony's question - has the Fed changed its plan and if so, why? Tony's implicit conclusion is that the Fed has changed its plan and he suggests hostility from politicians as a possible reason. Two more spring to mind if I think the Fed is, in part, simply being pragmatic.

Firstly, they might have changed course because the possible effects of running down the balance sheet - somewhat higher longer-dated yields, wider credit spreads, and maybe a knock-on to equity markets - would suit them. In a world where they face criticism for raising rates at the same time as they make little or no progress towards hitting their inflation target, maybe it's easier to shift attention slightly to the balance sheet. They always wanted to normalise it, and there's reasonable evidence that buying bonds has distorted asset markets. So why not do so that at a time when credit spreads are tight, global bond market are buoyant and the equity market is making new highs? Secondly, they'd much rather be the first major central bank to run down its holdings, than the last. Better not to sell into a crowded market.

The ECB faces a different problem. Concerns about the euro rising as they back scale bank bond-buying, just as it fell when they instigated the programme, seem hard to get around unless they just opt not to taper, and not to even think about thinking about raising rates.